Cold Chain Logistics: Management Challenges & Solutions

The supply chain is a term used to describe all the components required to transport goods from beginning to end, from production to the end...

12 min read

BUKU Marketing

:

Mar 8, 2023 1:00:00 PM

BUKU Marketing

:

Mar 8, 2023 1:00:00 PM

As an eCommerce store owner, you work hard for your profits. There’s nothing more infuriating than losing those profits to thieves and scammers. The internet is full of dishonest people looking to steal money from your business and customers.

Table of Contents

2. Why And How Does Ecommerce Fraud Happen?

3. The Most Common Types Of Ecommerce Fraud

4. How Does Ecommerce Fraud Affect Shopify Store Owners?

5. How Is Ecommerce Fraud Detected?

6. Best Practices For Ecommerce Fraud Prevention

7. What To Do After Fraudulent Activity Is Detected

Ecommerce fraud is a huge problem for online retailers and is only becoming more prevalent as the popularity of shopping online grows. The current estimates put the number of fraud attempts that eCommerce stores face every month at around 206,000. If you want to protect your cash, customers, and reputation, you need to take serious steps to prevent eCommerce fraud on your site.

This article will discuss some of the most common eCommerce fraud types and explain how you can protect your bottom line from unscrupulous internet thieves.

Ecommerce fraud happens when thieves and scammers use dishonest tactics to steal money or merchandise from eCommerce retailers. Credit card fraud, chargeback fraud, phishing scams, and interception fraud are some of the most common examples of ways that thieves can steal from eCommerce store owners and their customers. But no matter what form it takes, it all adds to losses for the retailer.

Ecommerce fraud is so prevalent because it's unfortunately easy to get away with. How easy? According to Cybersixgill, more than 23 million stolen debit and credit card numbers were up for sale on the dark web in the first half of 2019. All scammers need to do is get their hands on those stolen credit card numbers, and they've got free rein to steal from your store.

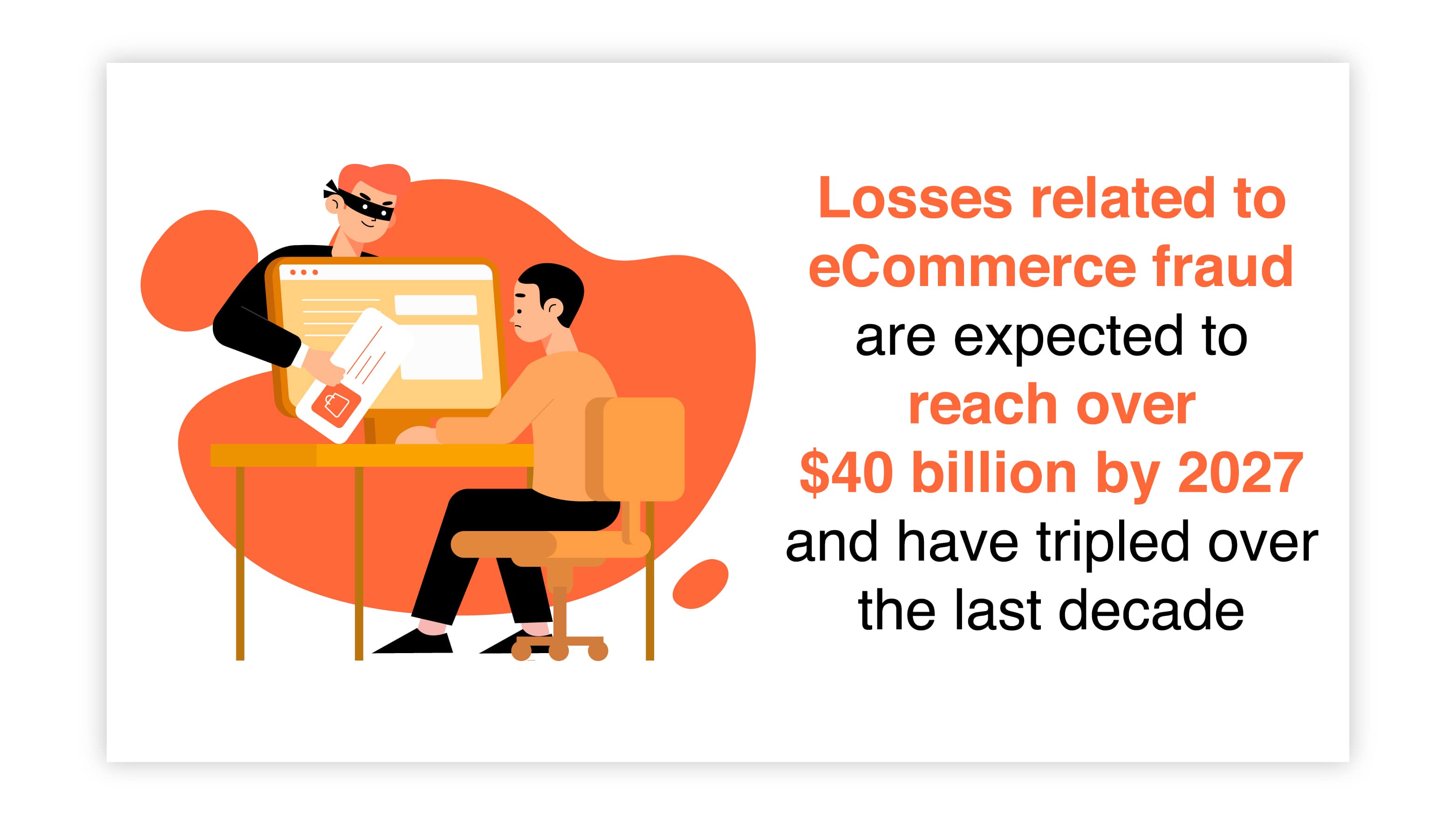

Losses related to eCommerce fraud are expected to reach over $40 billion by 2027 and have tripled over the last decade. What’s even worse is that fraudsters are becoming more adept at what they do, constantly inventing new and more effective ways of walking away with your hard-earned money. That’s why implementing an eCommerce fraud prevention strategy has never been more critical.

Ecommerce fraud prevention starts with an understanding of how online attackers steal money in the first place. Criminals are extremely good at what they do and often work in groups to prevent detection. Whether it's one dishonest scammer working solo, or an organized international crime syndicate, eCommerce fraudsters know how to get away with their crimes.

Because of the nature of online transactions, there's very little evidence to tie the criminal to the act and very little that authorities can do about the problem. Unless the theft involves a large sum of money, eCommerce fraud probably won't get much attention from the police.

Ecommerce fraud is too time-consuming to investigate and costly to prosecute. And often, these crimes occur internationally, making it much harder to find and prosecute the party responsible.

Criminals use many different methods to defraud online retailers. But a large percentage of the fraud attempts you will experience center around payment fraud, which means a criminal obtains stolen credit card information and then uses that information to make purchases on your site.

As we mentioned earlier, there are millions of stolen credit cards for sale on the dark web, and many times criminals get access to more than just a card number. Email addresses, social security numbers, passwords, and billing and delivery addresses are often included in the deal, which makes it easier for scammers to pull off their heists.

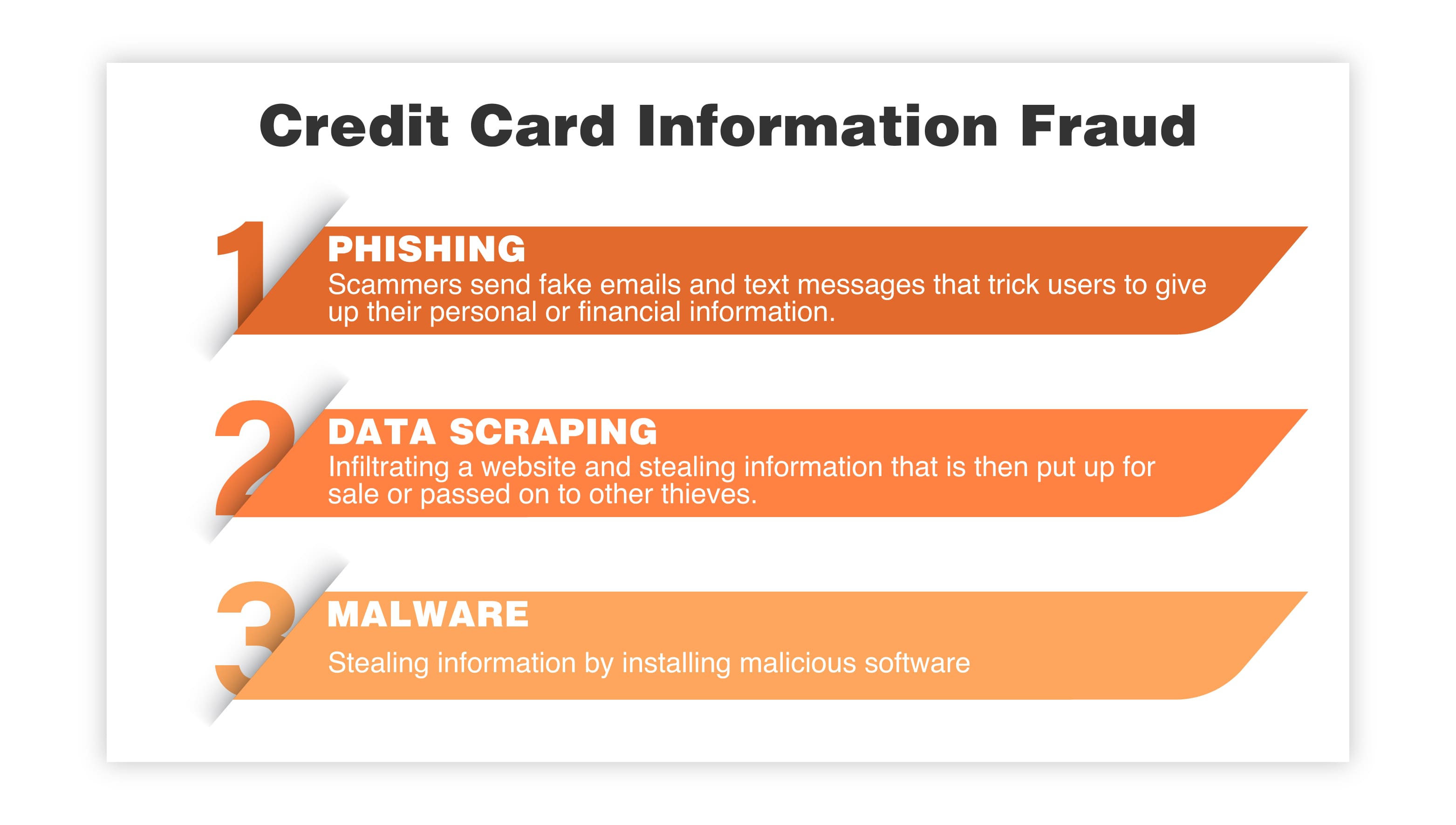

Crime rings will work together to steal credit card information from businesses through scams like:

Phishing – Scammers send fake emails and text messages that trick users into believing they are coming from a legitimate company and convince them to give up their personal or financial information.

Data Scraping – Infiltrating a website and stealing information that is put up for sale or passed on to other thieves.

Malware – Stealing information by installing malicious software onto an individual's computer.

Once a scammer gets their hands on a consumer's private payment information, they can sell it to other criminals on the dark web or pass it to other crime syndicate members. The next step involves someone using that stolen credit card information to purchase products on your eCommerce site to steal merchandise or defraud your business out of money.

To implement an effective eCommerce fraud prevention strategy, you must put security measures in place to prevent attackers from taking advantage of you. There are many ways that scammers defraud your business out of money or merchandise.

We have listed some of the most common and damaging methods below.

The oldest trick in the fraudster’s playbook is also one of the most effective. Credit card fraud, or payment fraud, occurs when criminals obtain and use stolen credit card information to purchase online. When a fraud attempt occurs, the criminal will likely max out that credit card before the actual owner is even aware they're the victim of a crime. Most consumers are offered fraud protection from their banks or credit card companies for such an occasion. But when all is said and done, the retail owner is left holding the bill.

Card testing is like credit card fraud because criminals are attempting to use stolen credit card numbers to make purchases online. The difference is that the fraudsters don't know if the cards are valid. They also might not be aware of the credit limit on the card, so they "test" the card to see if it works. Card testing schemes often involve stealing hundreds of credit card numbers at once.

Chargeback fraud, or friendly fraud, is another scam that has been around for a long time. The attack looks like a regular credit card purchase. But once the thief receives the merchandise, they request a chargeback from the card issuing company, claiming they never received the delivery.

They might also claim they returned the merchandise. The result is that the fraudster receives a refund of the merchandise from the card issuer, and once again, the retailer is left to eat the loss.

Refund fraud is a roundabout way for internet scammers to steal money without getting flagged by the card issuer. It typically works like this: the attacker purchases an item with a stolen credit card and then requests a refund for that purchase in some other form of payment.

Refund fraud is also called "friendly fraud" because it's common among non-sophisticated, solo scammers. One survey found that a staggering 40% of consumers have attempted to convince retail stores to issue fraudulent refunds for purchases.

As an online retailer, there's a good chance that many of your customers have personalized accounts on your site.

Fraudsters use many methods to access a customer's account - from phishing attacks to purchasing information from the dark web. The result is that the criminal now has access to the customer's information and can make fraudulent purchases with their information.

This type of fraud is considered an account takeover and damages both the customer and the retailer.

Triangulation fraud is an elaborate scheme where the attacker sets up an illegitimate eCommerce storefront, complete with underpriced products that represent a draw for consumers.

When customers attempt to purchase from that storefront, the scammers pocket the money from the sale and steal the consumer's payment information, which is then used to purchase a matching product from a real storefront. The customer receives the product they purchased, often never realizing they are the victim of a crime, and the criminal walks away with the profits.

Interception fraud is another intricate scheme that is growing in popularity. This type of theft takes advantage of a retailer's shipping process to steal merchandise that is in transit. Criminals "intercept" the delivery, steal the goods, and resell them for a profit.

Ecommerce fraud prevention is essential to stopping these types of theft attempts. One way to do this is to implement proof of delivery receipts for all packages. Signatures and photos prove that the delivery reached the intended recipient and didn't end up in the hands of a thief.

Ecommerce store owners often offer perks and discounts for new account owners, and this type of scam takes advantage of that. Attackers use stolen information to open one or several new accounts on a site to benefit from free trial offers and discounts.

One of the online scams with the largest potential to cost retailers a large sum of money is e-gift card fraud. Attackers use stolen payment information to purchase e-gift cards online and then resell those gift cards online for a profit.

Once again, the consumer realizes a theft has occurred, issues a chargeback, and receives a refund from the card issuer - and the retailer is left with the aftermath.

These are just a sampling of the most common ways criminals steal money from your online store, but the problem is that these unscrupulous actors are constantly inventing new ways to commit their crimes. An effective eCommerce fraud prevention strategy is essential to protecting yourself and your customers from these types of thefts.

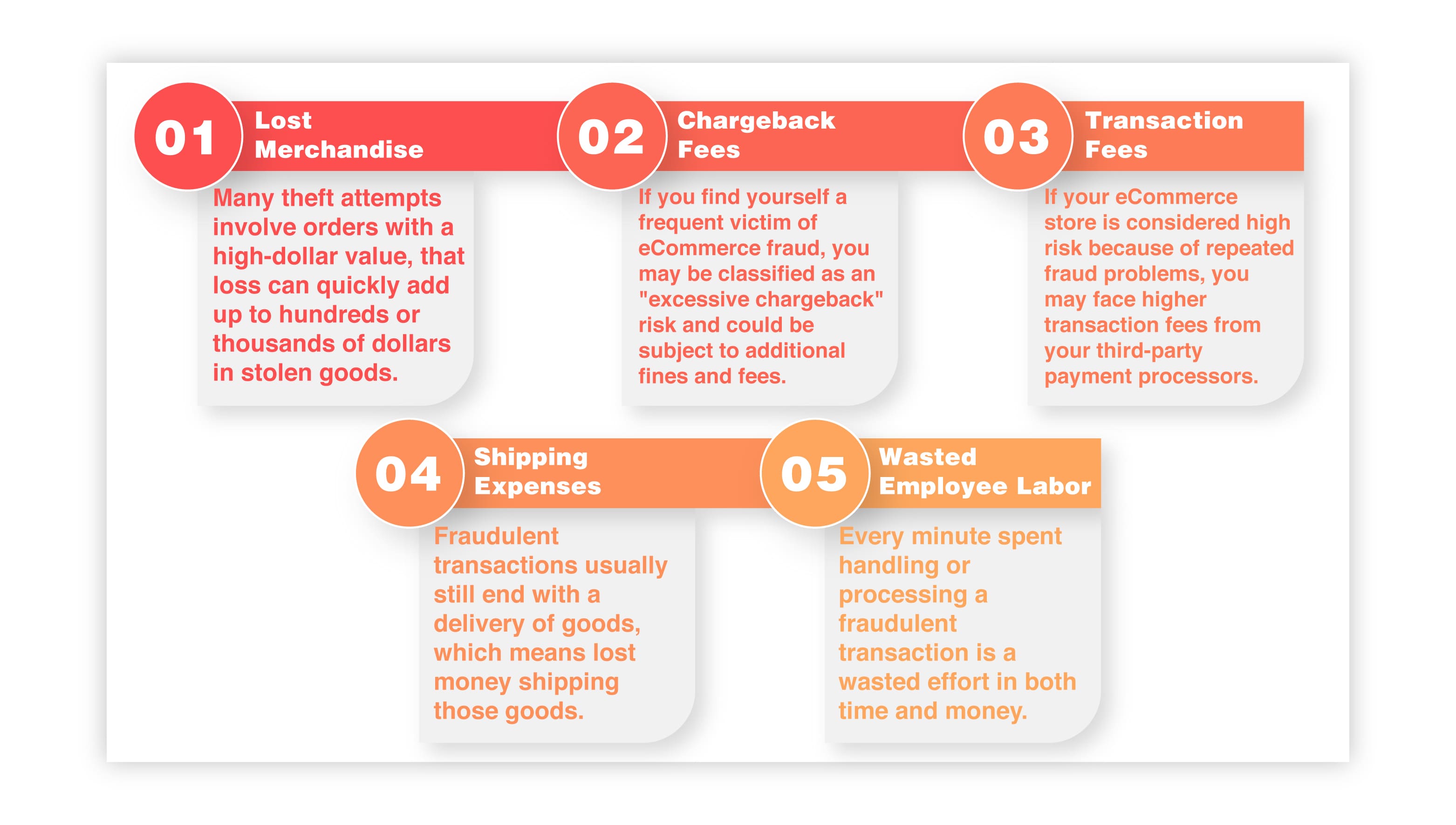

Ecommerce fraud can have a devastating effect on your business. The size and scope of that damage can be astronomical, especially if you aren't implementing eCommerce fraud prevention methods. But the losses you face might be more than just lost profits.

Let's look at how eCommerce fraud can negatively affect Shopify store owners.

Lost Merchandise – Fraud attempts can represent a significant loss of merchandise. Because many theft attempts involve orders with a high-dollar value, that loss can quickly add up to hundreds or thousands of dollars in stolen goods.

Chargeback Fees – When an online retailer faces a chargeback request, they must pay a fee, which can range from $15 up to over $100. If you find yourself a frequent victim of eCommerce fraud, you may be classified as an "excessive chargeback" risk and could be subject to additional fines and fees.

Transaction Fees – If your eCommerce store is considered high risk because of repeated fraud problems, you may face higher transaction fees from your third-party payment processors. Some may even require you to deposit money in an escrow account as overhead protection against fraud losses.

Shipping Expenses – Fraudulent transactions usually still end with a delivery of goods, which means lost money shipping those goods. Even if theft is detected, that money is lost forever and can represent a significant loss.

Wasted Employee Labor – If your eCommerce store uses employees, you must consider the number of payroll hours wasted because of eCommerce fraud. Every minute spent handling or processing a fraudulent transaction is a wasted effort in both time and money.

Ecommerce fraud prevention tactics can reduce some of the monetary losses retailers face from scammers. But the damage to a business's reputation is harder to prevent and even harder to remedy once it has occurred.

A recent survey found that 40% of consumers in the U. S. say if their online accounts were compromised on an eCommerce site, they would blame the retailer. And worse, 66% said they would never return to an eCommerce store if their account were compromised on that site. Once those customers become the target of scammers, you have lost their business forever.

One unhappy customer can cause a ripple effect on your business by spreading negative reviews online and on social media. The result is damage to your reputation, the brand you have worked so hard to build, as well as the loss of future potential customers.

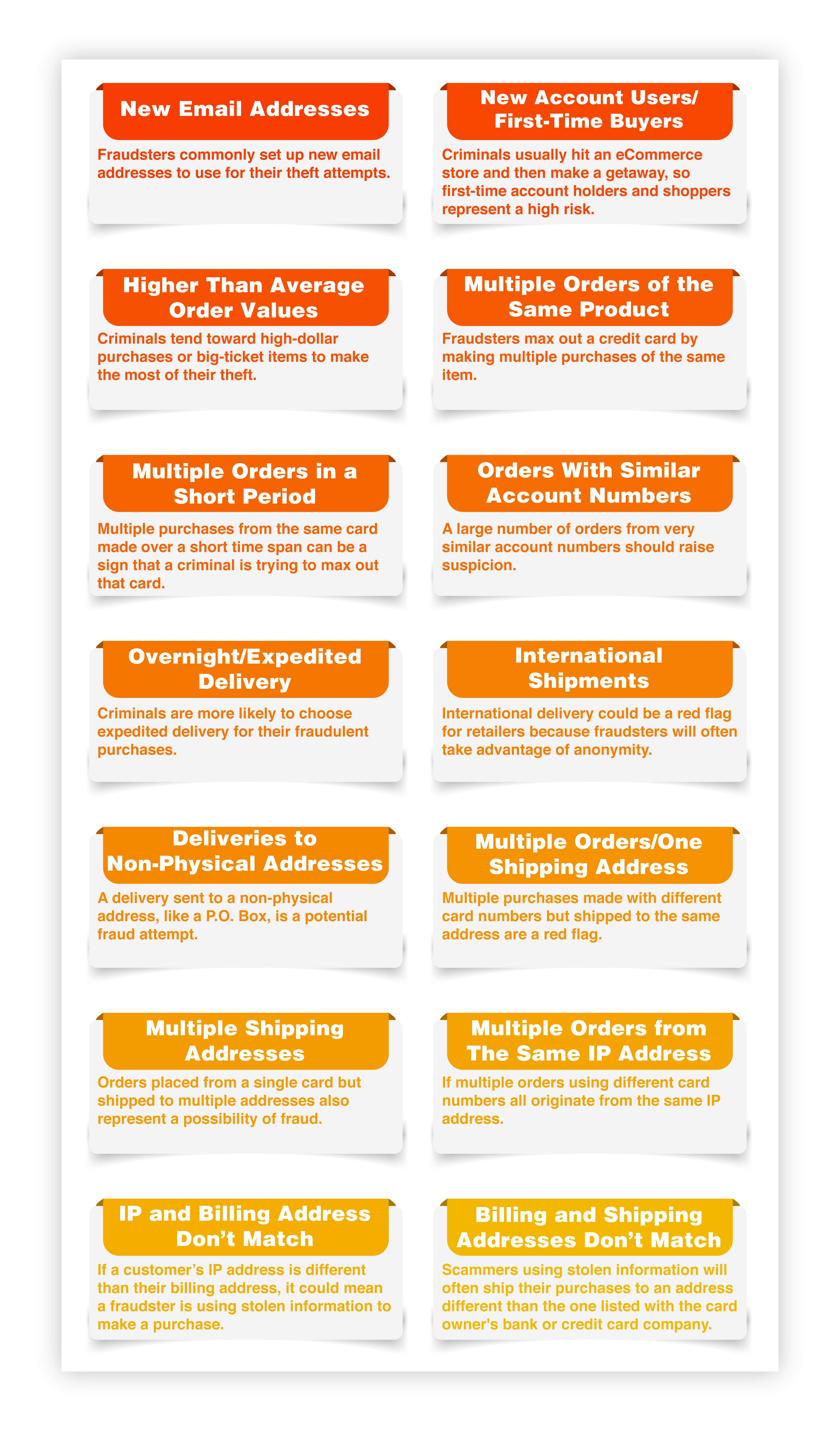

Ecommerce fraud prevention helps retailers reduce their chances of becoming victims of eCommerce fraud. It requires identifying the signs that fraud is occurring so that you can act accordingly and stop it.

Here are some tips on recognizing red flags that might signal fraud is happening in your store.

So, what makes an eCommerce store a soft target for fraud? It all boils down to eCommerce fraud prevention tactics and whether you are using them effectively. Now that you know how fraudsters steal from you and what kinds of things to be on the lookout for, you can put safeguards in place to help you identify these scenarios before they happen.

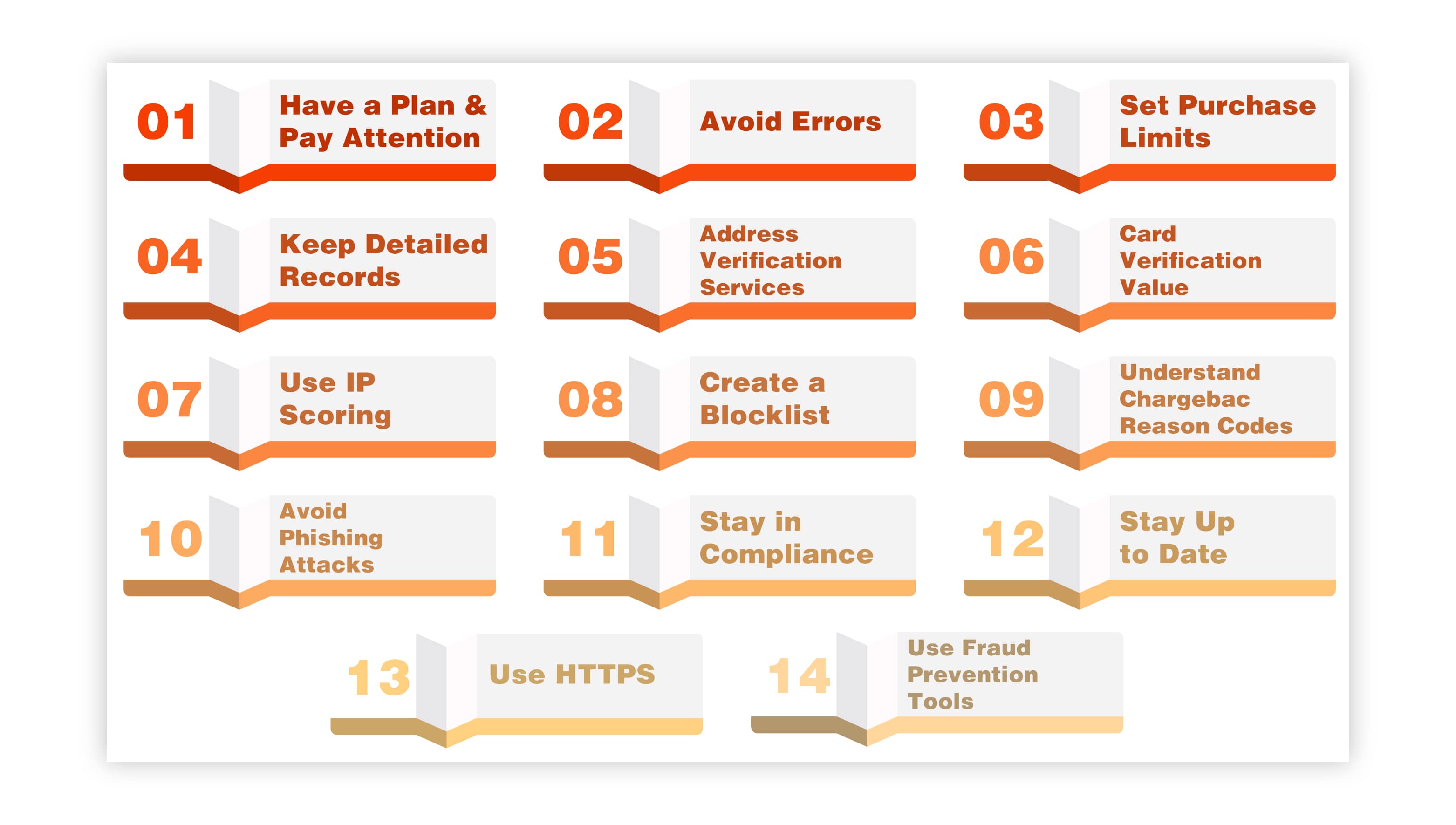

Here are our best tips for implementing an effective eCommerce fraud prevention strategy and what you can do to reduce your risk of becoming a victim.

The first thing you need to do is be vigilant. Track your chargeback percentage and the dollar amount losses represent to your business to understand when changes are necessary. As your business grows, your fraud prevention efforts should scale as well.

If you are doing your part to keep legitimate chargebacks to a minimum, it will be easier to spot the ones that might be fraudulent. It’s estimated that between 20% to 40% of chargebacks result from errors on the part of the merchant – things like poorly communicated return policies or confusing billing descriptors.

One of the most effective eCommerce fraud prevention techniques is simple. Set purchase limits to prevent fraudsters from making multiple purchases very quickly or limit the number of similar products customers can purchase simultaneously.

Being a vigilant record keeper improves your chances of successfully fighting chargeback attempts. You should have a record of every piece of information related to an order.

These services will check if the billing address entered during a purchase matches the billing address on file with the card issuer and red flag those that don’t.

That three or four-digit security number on the back of your bank or credit card is a fraud prevention measure. Because it’s illegal for merchants to collect these numbers, requesting them ensures that customers have the physical card at checkout.

Ecommerce store owners can use IP scoring tools to flag IP addresses previously associated with fraud attempts.

Blocklists help stop fraudsters from repeatedly victimizing your business. Keep detailed records of past fraud attempts and use that information to red-flag repeat offenders.

Successfully fighting chargebacks will be much easier if you understand the specific codes associated with different types of chargebacks.

Phishing attacks trick consumers into sharing their payment or personal information with the wrong people, but they can also represent a risk to retailers. Malicious software embedded in emails can wind up on your computer, putting you and your customers in danger. Research shows that one in every 99 emails is a phishing attempt.

The Payment Card Industry (PCI) Security Standards Council has rules and regulations that merchants must follow to protect consumers from fraud. Retailers who don’t follow these rules put their customers at risk and face potential fines and penalties as well.

Out-of-date systems are at a higher risk for fraud and scams and are often an easy target for criminals. Update your system and anti-virus software regularly and keep backups safe.

HTTP stands for Hyper Text Transfer Secure Protocol. Using HTTPS ensures that the data transmitted between your eCommerce store and your customer’s browser is encrypted, making it safer for both of you.

Most eCommerce platforms have built-in fraud prevention safeguards. Shopify Protect, for example, offers store owners tools to help flag and prevent potentially fraudulent transactions. Shopify Protect even offers retailers reimbursement for fraudulent Shop Pay transactions, including the total cost of the loss and the chargeback fee.

Prevention is the best medicine, and eCommerce fraud prevention is the only way to protect your business from dishonest internet scammers and thieves. But what do you do after fraud has already occurred?

Generally, fraud occurring on your site results in a chargeback. Fighting those chargebacks will require detailed record-keeping and an understanding of the process. This will help weed out legitimate chargeback requests from fraudulent ones. But the protections in place around eCommerce transactions are mostly designed to protect the consumer. For the most part, store owners are left to protect their interests.

The first thing you should do after identifying fraud on your site is determining what kind of fraud is happening. Identifying exactly how scammers steal from you, especially if it's repeatedly happening, will help you pinpoint weaknesses in your fraud prevention methods.

When fraud is identified, it represents an opportunity for improvement. If fraudsters exploit weaknesses in your system, your shipping process, or your third-party partners, something needs to change. Look for ways to prevent repeated fraud attempts by implementing new systems and prevention methods.

Fraudsters aren't taking a day off when it comes to stealing from you, so you can't either. Be aware of what's happening on your site. Run manual checks on transactions that seem suspicious. Educate your employees on what to look for and what to do if they suspect fraud. And put the right tools and systems in place to help you identify and stop fraud before it happens.

Ecommerce fraud costs online retailers a huge amount of money. It also results in lost customers, a damaged reputation, and difficulty building a successful business.

It's unfortunate that you will never be able to completely prevent fraud from occurring in your eCommerce business. But with the right eCommerce fraud prevention measures, you can reduce your risk significantly.

Your customers expect you to take steps to protect them while they shop on your site. Choosing not to put the right tools in place to help you do that leaves them exposed to theft and risks your business. Take steps today to make the changes that will protect you and your customers.

The supply chain is a term used to describe all the components required to transport goods from beginning to end, from production to the end...

A smart warehouse is a large building where raw materials and other consumer goods are stored using machines, computers, comprehensive software, and...

Direct-to-consumer (DTC) fulfillment is a strategy that helps brands sell and deliver their products directly to customers more efficiently while...