Cold Chain Logistics: Management Challenges & Solutions

The supply chain is a term used to describe all the components required to transport goods from beginning to end, from production to the end...

10 min read

BUKU Marketing

:

Feb 15, 2023 1:00:00 PM

BUKU Marketing

:

Feb 15, 2023 1:00:00 PM

Running a successful Shopify store requires making sales. However, many eCommerce store owners don’t realize that the process often doesn’t end once the sale is complete.

That’s because an average of 2.59% of all eCommerce transactions result in a chargeback dispute.

Table of Contents

1. What Are Chargeback Disputes?

3. Quick Tips on Handling Chargebacks

4. Dealing With Chargeback Fraud Transactions

5. Chargebacks From Products Not Received, Delayed, Or Unacceptable

6. How To Handle Chargebacks In General

7. Fraud Detection Tools And Prevention Services

8. Have A Strong Customer Verification Process

9. Final Thoughts To Prevent Chargebacks In Shopify

That means the customer took specific action with their bank or credit card company after purchasing to reverse a sale. That leaves the retailer in the unhappy position of losing money and their reputation.

According to Chargebacks 911, these disputes end up costing eCommerce stores around $40 billion annually.

For small eCommerce businesses, lost revenue resulting from chargebacks can significantly impact their bottom line and might even mean the difference between success and failure.

There are multiple reasons a customer might initiate a chargeback dispute. Sometimes it's a failure on the retailer's part, such as a customer never receiving a purchase or receiving the wrong item altogether.

Chargebacks also occur because of billing errors or clerical mistakes. But they most often occur because of fraudulent activity by dishonest customers.

Knowing how to handle chargebacks and implementing strategies to prevent chargebacks in Shopify stores will help you mitigate those losses and protect your reputation.

In this post, we will define what a chargeback is, discuss how to handle them correctly, and offer some helpful tips to prevent chargebacks in your Shopify store.

A chargeback occurs when customers dispute a credit card charge with their bank or credit card company. Instead of the customer contacting the retailer directly for a refund, they contest a payment via the card issuer.

This contest leaves the retailer with a decision – either agree to the chargeback and lose money or fight the chargeback to prove that the sale was legitimate. Fighting a chargeback dispute successfully is possible, but it costs the retailer valuable time.

This time is why it's beneficial to implement strategies to prevent chargebacks in Shopify before they happen.

When a chargeback occurs, the retailer is out not only the product cost, but also any associated processing, shipping, and handling costs.

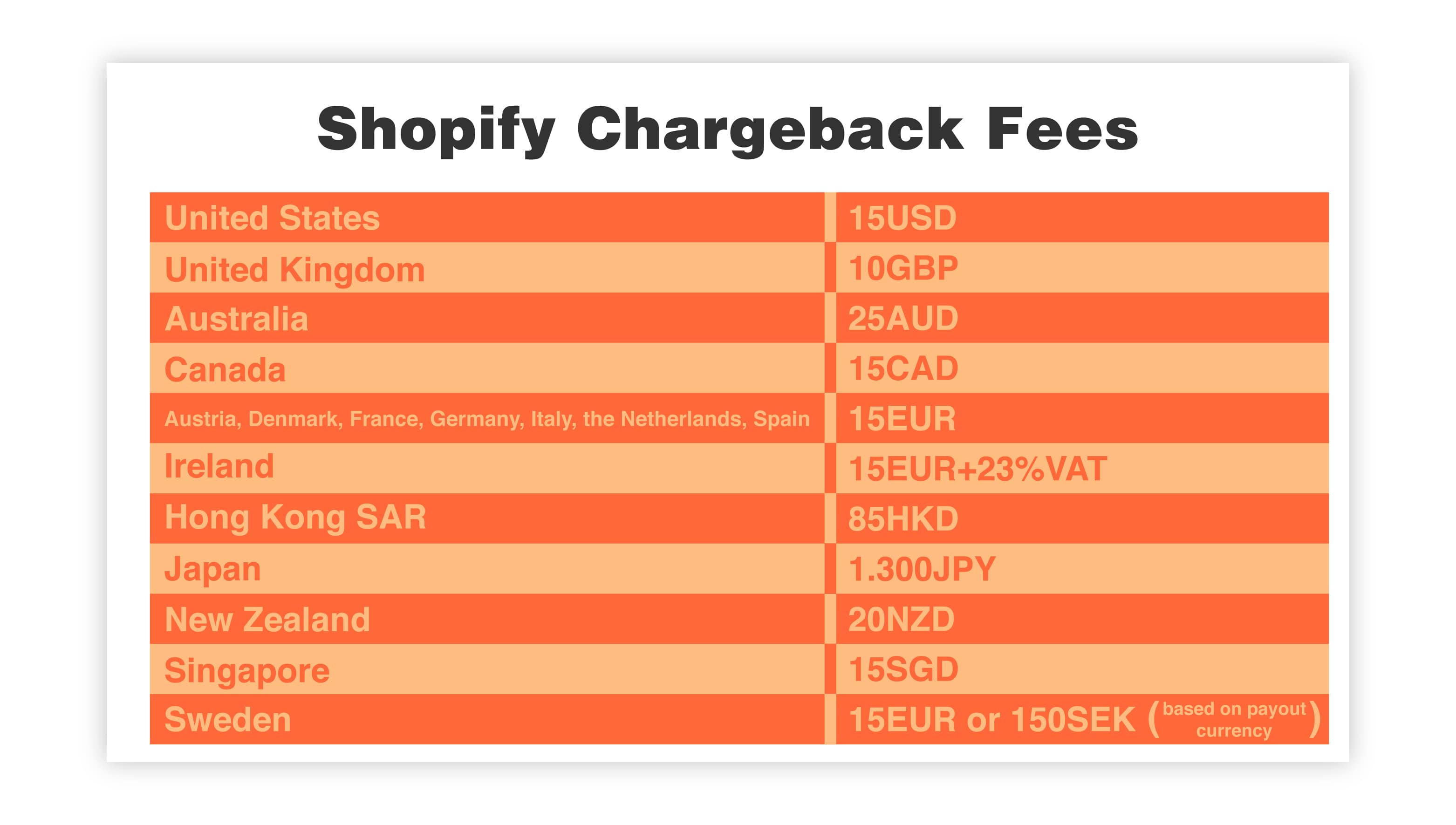

On top of that, Shopify charges fees for every chargeback. It’s easy to see how the estimated chargeback cost can be between $15 and $100, and as much as 2.60X the value of the merchandise itself.

The Shopify chargeback fee varies depending on the country where the sale occurred. It’s important to note that these fees are current as of the publication of this post and are subject to change at any time.

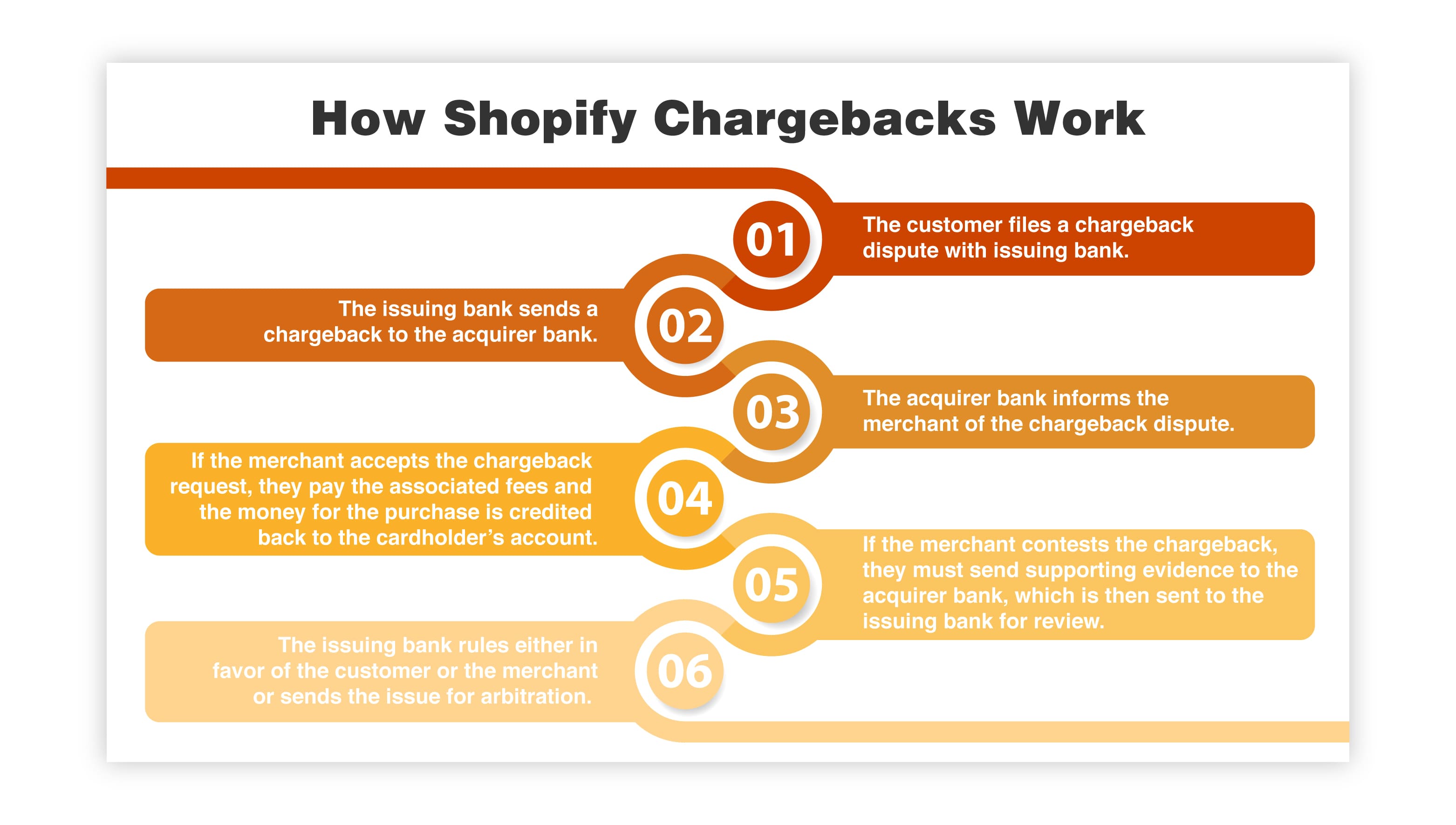

When a customer issues a chargeback dispute, it sets off a sequence of events. The outcome of this process will depend on the reason for the chargeback dispute, whether it's valid or not, and how dedicated you are as a retailer in fighting fraudulent chargebacks.

You can see that the cost of chargebacks can be significant for online retailers. That's why reducing the percentage of transactions that result in chargeback requests is so important.

There are numerous reasons a chargeback might occur. Preventing chargebacks in Shopify stores will require understanding these reasons and learning ways to prevent them.

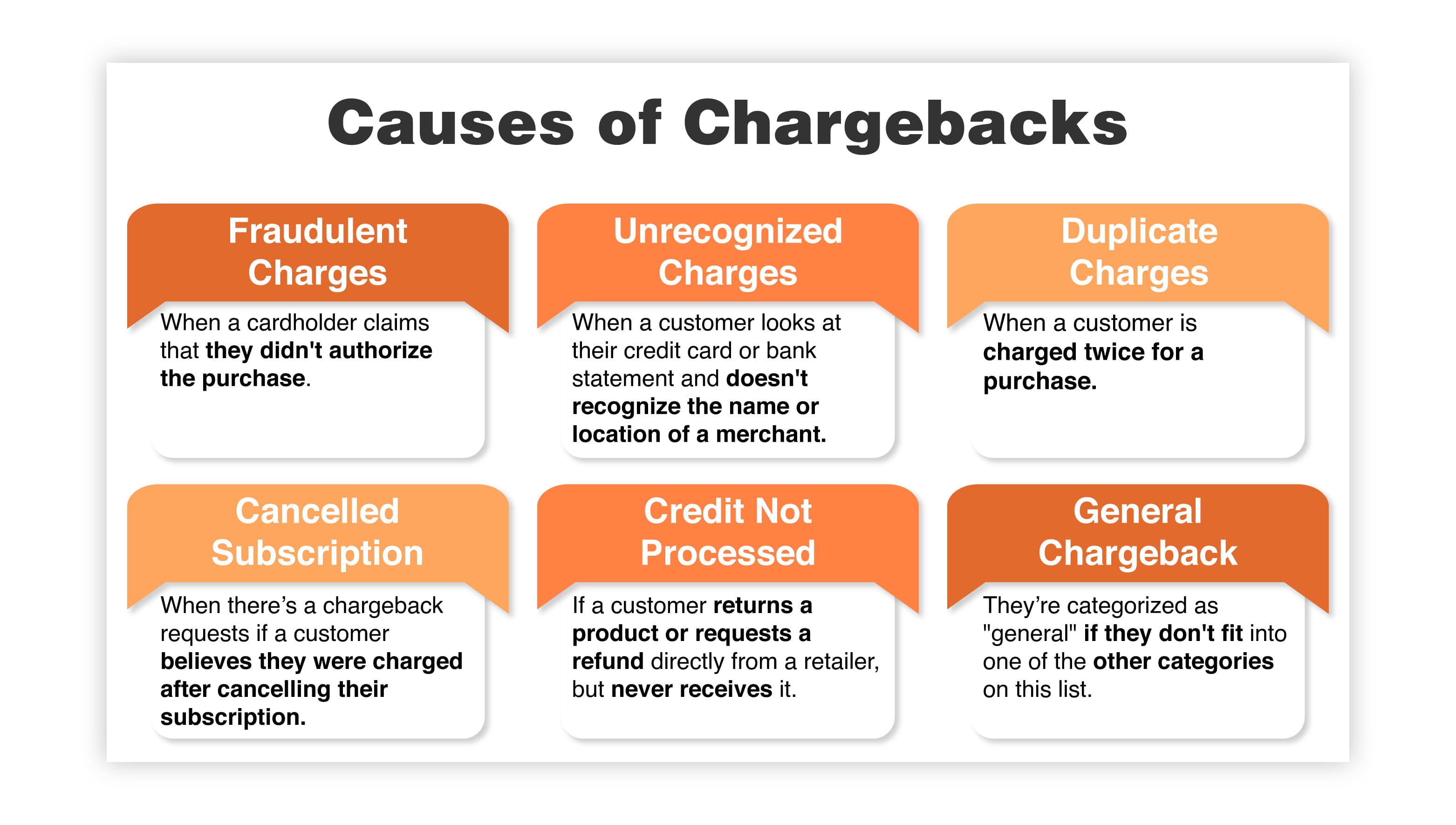

● Fraudulent Charges

Fraud causes chargebacks when a cardholder claims that they didn't authorize the purchase. This can happen for legitimate reasons, such as a stolen credit card. But it can also happen because of dishonest customers, known as "friendly fraud."

Chargebacks initiated because of fraud are the most common type for Shopify stores, but what’s most damaging to retailers is that only 30% of those chargeback disputes result from an actual stolen card. The remaining percentage result from "friendly" fraud.

● Unrecognized Charges

A chargeback characterized as unrecognized happens when a customer looks at their credit card or bank statement and doesn't recognize the name or location of a merchant.

It might also be the result of a forgetful customer who simply doesn't remember making or purchase (or allowing a friend or family member to make a purchase).

● Duplicate Charges

When a customer is charged twice for a purchase (or believes that they were), they might initiate a chargeback for this reason. To dispute this charge, you will need to prove that the purchases occurred on separate occasions and were for different products or services.

● Cancelled Subscription

Retailers who sell services through a subscription service might experience chargeback requests if a customer believes they were charged after canceling their subscription. This chargeback request might also happen if a customer expected notification before a recurring charge or signed up for a free trial with the agreement that not canceling in time would result in a charge.

● Credit Not Processed

If a customer returns a product or requests a refund directly from a retailer but never receives it, they can request a chargeback. Contesting this chargeback will require submitting proof that you already refunded the customer’s money or that the customer was not entitled to a refund.

● General Chargeback

Chargebacks are categorized as "general" if they don't fit into one of the other categories on this list. Some other reasons for a chargeback occur when customers don't receive a product, they purchased when shipping delayed the product’s delivery beyond what they deem acceptable, or when the shipment arrives in unacceptable condition. We will talk more about these chargeback causes later in the post.

Being a successful business owner requires handling customer disputes, and chargebacks are no different. Ignoring a problem that results in lost revenue is not a sound business practice. Preventing chargebacks on Shopify is a vital step to protecting your bottom line and your overall reputation. Here are a few reasons why.

The most obvious cost of chargebacks is the actual monetary cost. Chargebacks result in the loss of the value of the product itself; the money spent making the sale, including advertising and processing, as well as the cost of shipping and handling. Tack on the Shopify chargeback fee and you’re looking at a substantial loss.

Customers who initiate a chargeback for a legitimate reason are likely unhappy with their experience. Whether they were double charged, never received a refund, or were charged after canceling a subscription, the result is a dissatisfied customer who might leave negative reviews of your store.

Retailers who experience many chargebacks indicates a red flag for Shopify. A chargeback directly impacts what is known as your “chargeback-to-transaction ratio.” Shopify can act against retailers with an inflated percentage of chargebacks by increasing the associated fees and even suspending or revoking payment card processing privileges altogether.

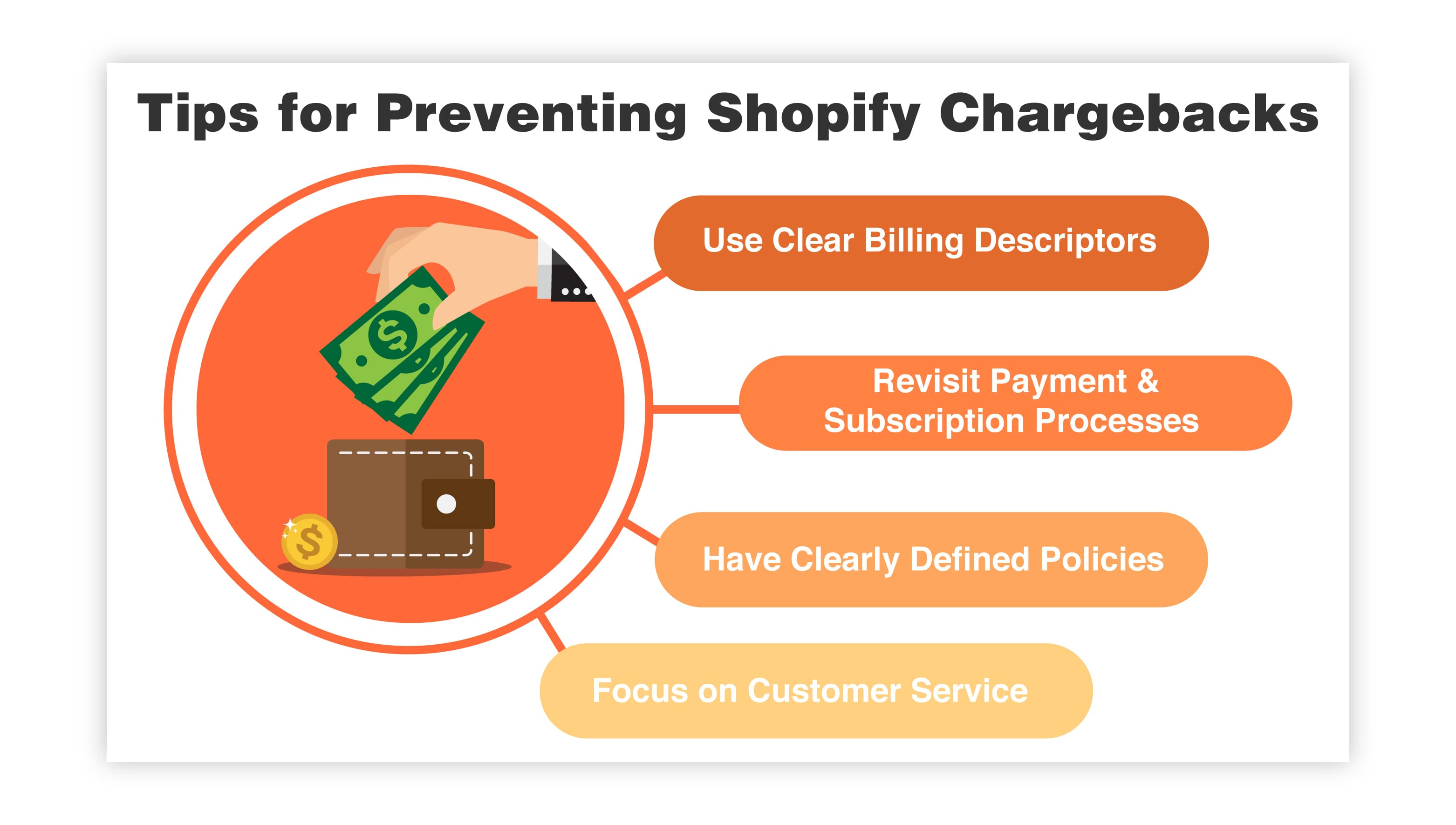

Use Clear Billing Descriptors – Ensure that the customer will recognize your Shopify store name and the products they purchased, so they won’t be confused when looking at their card statement.

Revisit Payment and Subscription Processes – Whether it's an error with your payment processing system or a mistake resulting from poor training of customer service associates, make sure you eliminate internal errors that might result in chargebacks.

Have Clearly Defined Policies – Make sure that return and refund policies are clearly defined and available to customers before their purchase, so there will be no misunderstanding about an acceptable return.

Focus on Customer Service – Providing stellar customer service will help prevent chargebacks because you will be better able to communicate with the customer. Focusing on ensuring the customer is satisfied with their experience from start to finish will prevent many chargebacks.

A fraudulent transaction is a purchase the cardholder did not authorize. Unfortunately for retailers, the lions-share of chargebacks will be classified as fraud, and even more unfortunate – the largest percentage of these are the result of friendly fraud.

Statistics show that 75% of eCommerce retailers reported an increase in fraud in 2021 and that eCommerce fraud increased by 18% from 2019.

Friendly fraud is the number one cause of fraud chargebacks. The good news is that there are ways to prevent chargebacks on Shopify that are the result of fraud.

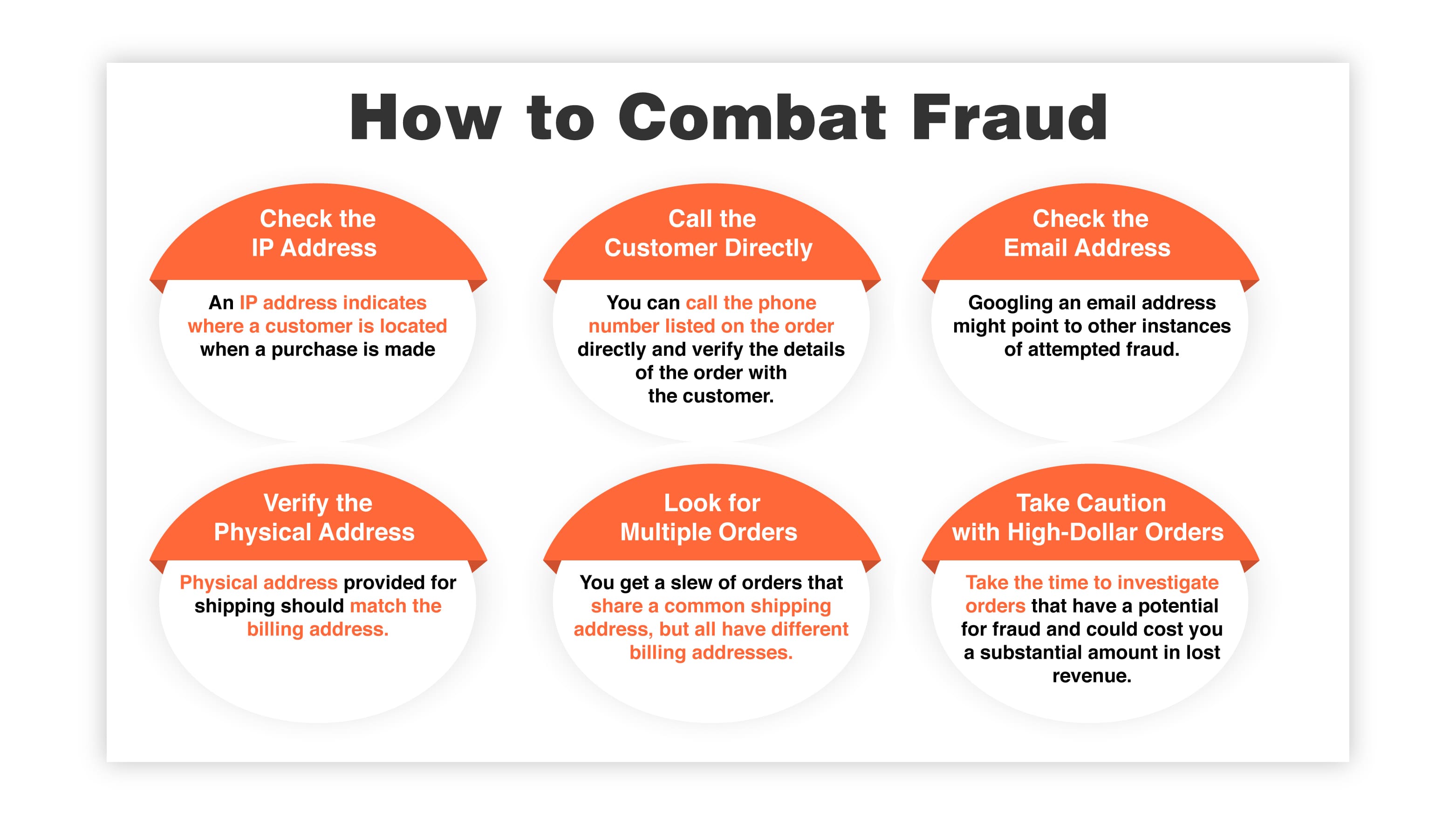

Check the IP Address – An IP address indicates where a customer is located when making a purchase. If the IP address doesn't match the customer's address or is associated with a web hosting company or proxy service, there's a high potential that the transaction is fraudulent.

Call the Customer Directly - If you suspect a transaction might be fraudulent, you can call the phone number listed on order and verify the order's details with the customer. There are also tools online that will allow you to determine if the location of the phone number matches the billing address.

Check the Email Address – Googling an email address might point to other instances of attempted fraud that involved that same address or other incriminating evidence.

Verify the Physical Address – Ensuring that the physical address provided for shipping matches the billing address is another way to identify potential fraud. Differing addresses don't always indicate fraud, but a significant difference in location, like a foreign address, could be a red flag.

Look for Multiple Orders – If you get a slew of orders that share a common shipping address but all have different billing addresses, that’s cause for concern.

Take Caution with High-Dollar Orders – Orders that include many products or involve exceptionally high-value items should receive extra attention from you as the retailer. Take the time to investigate orders that have a potential for fraud and could cost you a substantial amount of lost revenue.

Some chargeback disputes are beyond your control. While you can implement safeguards to help prevent chargebacks on Shopify, they’re still likely to happen. Friendly fraud is one example of this. Another is problems that occur during the shipping process.

When a customer makes a purchase and never receives their shipment, a shipment is significantly delayed, or a package arrives in unacceptable condition, they can contact the retailer directly to request a refund.

A percentage of these customers will take this route. However, some will jump directly to a chargeback request instead.

Chargebacks like these are designed to protect consumers from dishonest retailers, who charge them for products that are never shipped or misrepresent the products they are selling.

As a retailer, you are responsible for correctly portraying the products you sell in your store and for ensuring that those products arrive as expected. Failure to do so can result in a costly chargeback.

Of course, not every mishap during the shipping process is your fault. Some things are just beyond your control, and shipping is one aspect of eCommerce that is partially out of your hands.

However, there are steps you can take that will help reduce the potential for chargebacks related to missing, damaged, or delayed deliveries.

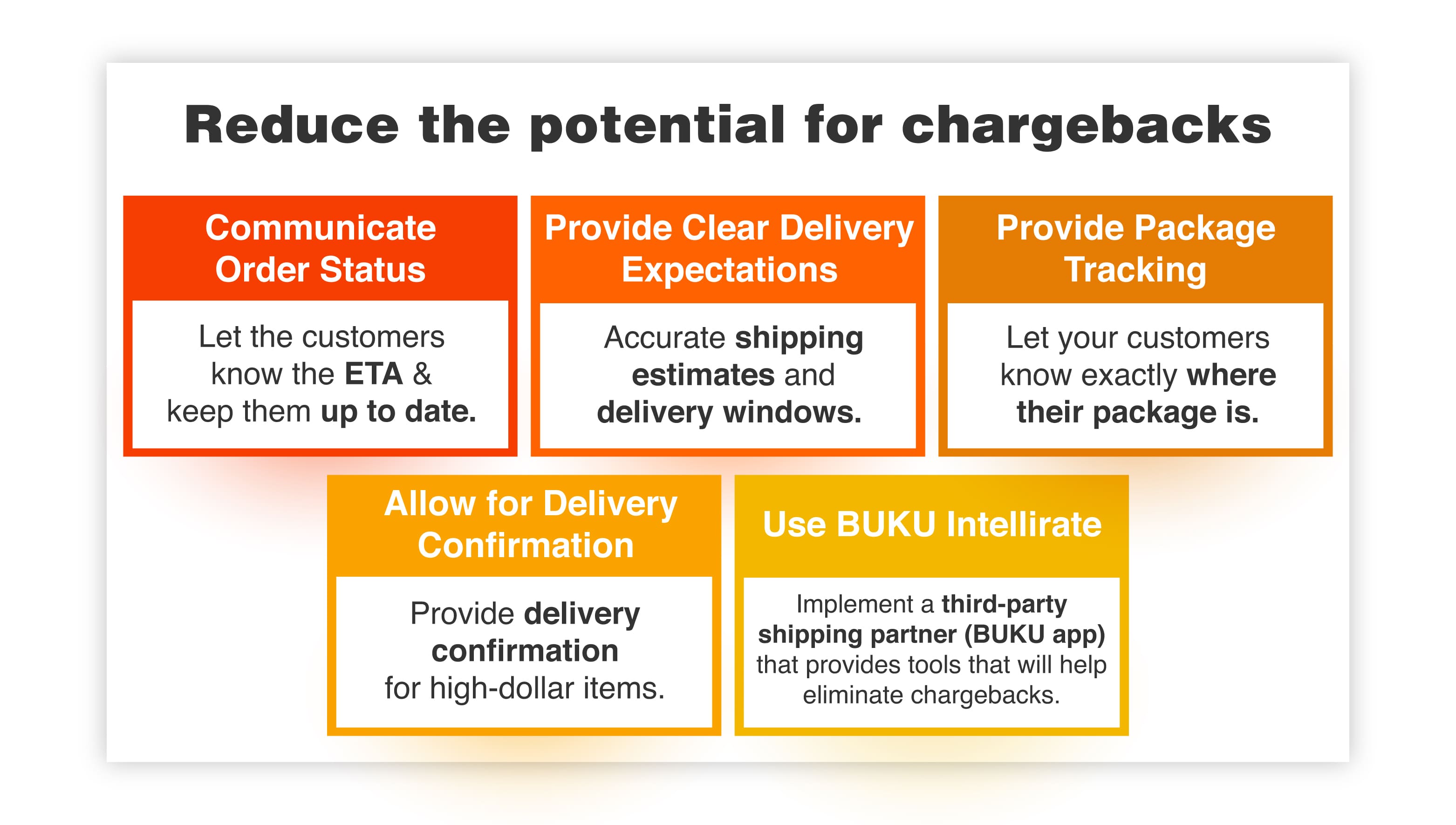

Communicate Order Status - Make sure your customers know exactly when they can expect their packages to arrive and keep them up to date on potential delays.

Provide Clear Delivery Expectations – Ensure you communicate accurate shipping estimates and delivery windows during the order process.

Provide Package Tracking – Let your customers know exactly where their package is, when it’s leaving the warehouse, and when it will arrive on their doorstep. This will prevent customers from requesting a chargeback because they’re unaware it was delayed during shipping.

Allow for Delivery Confirmation – Providing delivery confirmation for high-dollar items will prevent misunderstandings and help combat stolen packages. It also prevents customers from claiming they never received a package.

Use BUKU’s app IntelliRate – Implementing a third-party shipping partner, like BUKU’s app IntelliRate, provides you with a host of tools that will help eliminate these types of chargebacks.

IntelliRate provides package tracking capabilities and real-time delivery estimates that work with hundreds of global carriers and help you find the lowest shipping cost every time.

The best way to prevent chargebacks on Shopify is to be proactive. Putting the right systems in place before making a sale will help ensure that you and your customer are protected and happy with the result. Prevention is the best medicine, and that holds here as well.

Taking steps to reduce the number of chargebacks will help mitigate your losses. But you won’t be able to eliminate chargebacks, which means knowing how to handle the situation after it occurs. Here are some of our best tips for handling chargebacks after they happen.

Approach the Customer Directly – Reaching out to a customer after they initiate a chargeback dispute might allow you to solve a problem directly. If you can offer a solution that satisfies that customer, you can request that they cancel the chargeback request.

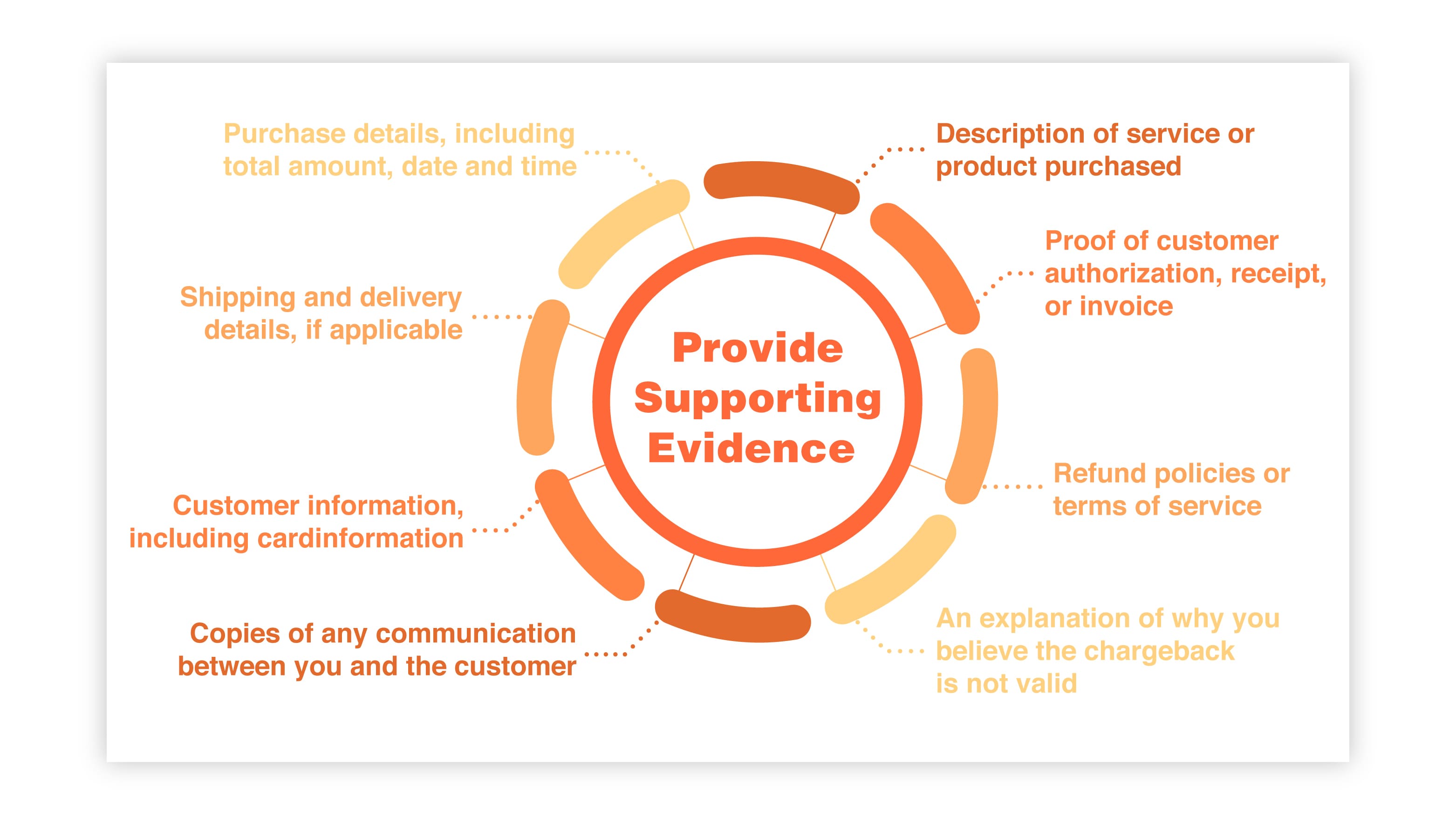

Provide Supporting Evidence – If you contest the validity of a chargeback, you will need to send ample evidence to the issuing bank to support your claim. The more evidence you can provide to prove your case, the better your chances of a positive outcome.

Include things like

Shopify is an excellent platform for eCommerce retailers because it's cost-effective and easy to set up, even for first-time entrepreneurs. They also provide helpful tools to make running your business easier, including built-in tools to help prevent chargebacks on Shopify.

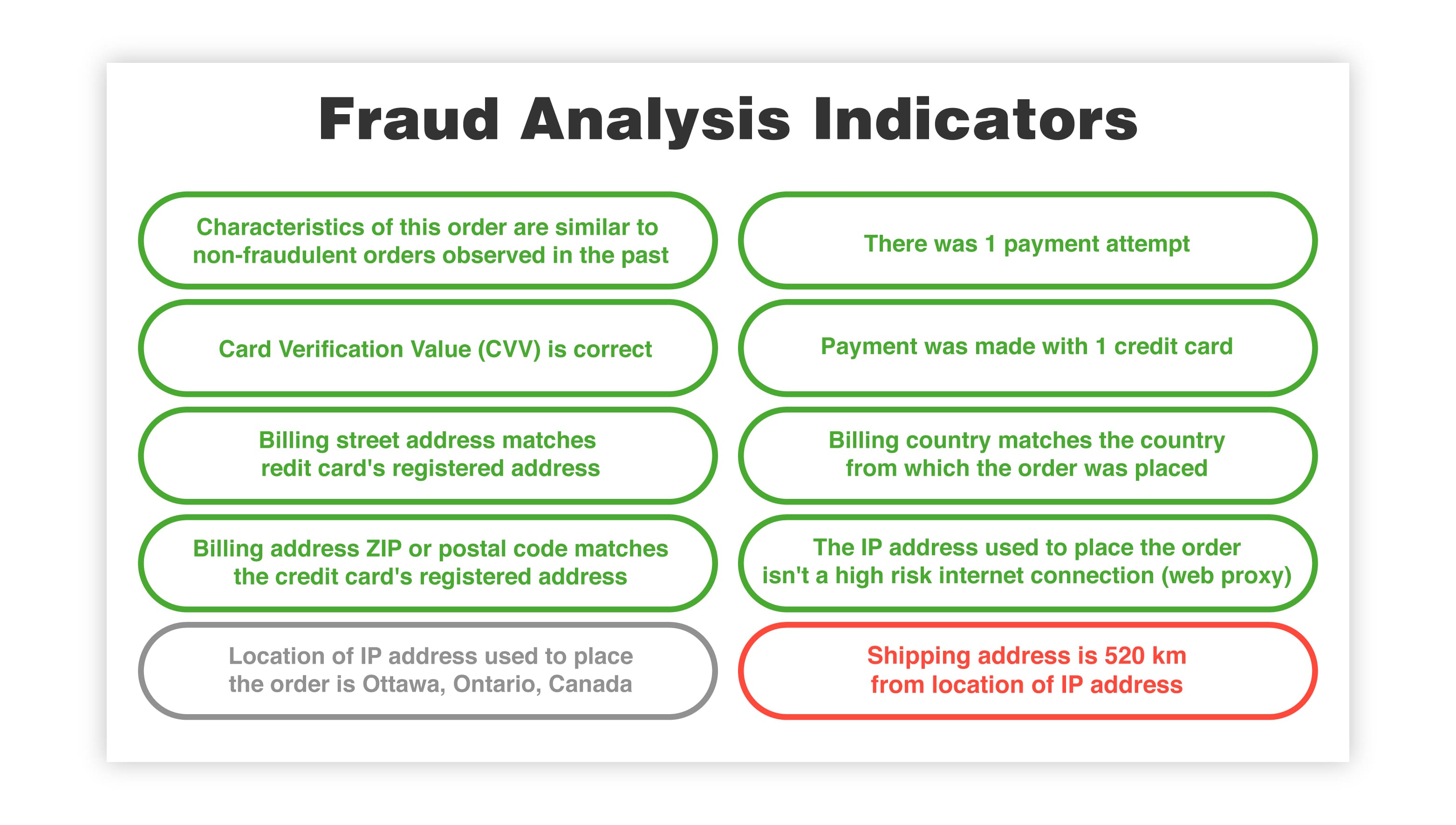

Shopify Fraud Analysis – Shopify offers retailers access to fraud prevention services through their fraud analysis system. This provides built-in tools that automatically analyze the risk involved with each transaction and flag those with either a medium or high potential for fraud.

Shopify looks for instances where billing and shipping addresses don't match, customers with a high order volume, or multiple orders placed quickly. Identifying these orders ahead of time allows you to take further investigative action before authorizing a purchase.

Shopify Protection – Shopify offers this free tool that protects U.S.-based retailers from fraud on eligible Shop Pay transactions. If a fraudulent chargeback occurs, Shopify will cover the cost of the order and waive the chargeback fee.

Shopify Payments – Shopify Payments provides retailers access to Shopify’s automatic dispute response. This helps retailers save time and money by using a tool that automatically initiates and handles dispute requests for you.

Shopify Flow – If you sign up for an advanced Shopify plan, you will get access to Shopify Flow. This tool allows you to automatically set actions triggered when orders are flagged as high-risk, such as delaying the payment or canceling the order altogether.

Third-Party Fraud Prevention Tools – Aside from the protections offered directly by Shopify, retailers can implement third-party applications designed to combat fraud.

Another prevention measure you can use to prevent chargebacks on Shopify is a solid customer verification process. Knowing who your customers are can save you a lot of time and money in fraudulent chargebacks.

This means obtaining pertinent information from your customers before a sale, such as their name, billing, and shipping address, phone number, and email address. This information gives you a head start if you need to reach out directly to customers and helps protect you from fraudulent chargebacks.

When fraudsters see that you are taking all the necessary precautions and are paying attention, they will be less tempted to take advantage of you.

If you have employees working the front lines for you, then educating them on the details of chargebacks is essential. When your employees know what to look out for and how to prevent obvious fraud, your reputation and profit will be better protected.

Package tracking and delivery confirmation are two of the most effective tools for combating fraud. It will be much easier to dispute a fraudulent chargeback if you can prove that the package reached the right person.

Make sure you are extra vigilant during peak business seasons, like the holiday sales increase, fraud increases as well. Statistics show that the number of fraud attempts during the Black Friday shopping weekend in 2021 was 25% higher than in the previous months.

Running a successful business requires you to be vigilant and proactive. This is especially true for eCommerce retailers because much of their profitability is tied up in successful sales.

Any time a sale goes south, a refund is requested, or a chargeback dispute is issued, it eats directly into that profitability.

Putting the right systems in place beforehand is essential to protecting yourself from chargebacks. Utilize the tools that the platform offers to prevent chargebacks on Shopify. Review your policies and procedures to identify areas where improvements might help identify potential fraud before it happens.

Educate yourself about the chargeback process and know what to do when it happens so you will be able to handle the bill. Keep good records of every communication and transaction so you have a paper trail of evidence, in the event you need to prove a chargeback is fraudulent.

Above all else, make customer service your priority. Retail is all about the customer and focusing on providing an excellent experience from start to finish will help prevent many chargebacks before they even happen.

Make the customer happy, inform them honestly about what they are buying, and be upfront about your return policy and shipping processes. When the customer has no reason to be unhappy, they will have no reason to ask for a chargeback.

The supply chain is a term used to describe all the components required to transport goods from beginning to end, from production to the end...

A smart warehouse is a large building where raw materials and other consumer goods are stored using machines, computers, comprehensive software, and...

Direct-to-consumer (DTC) fulfillment is a strategy that helps brands sell and deliver their products directly to customers more efficiently while...